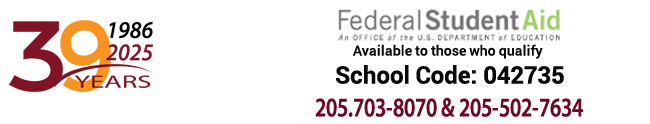

Federal Financial Aid Program

Winonah School of Cosmetology participates in Federal Financial Aid programs.

The School��s Financial Aid Office aids students seeking financial aid for their educational costs while complying with all federal, state and institutional regulations. Anyone seeking financial aid information or assistance or seeking consumer information at the school will be provided with access to the required financial aid forms and disclosures, the school Catalog and Handbook which provides a brief description of the Financial Aid process and explains how financial aid information and assistance may be obtained.

To remain eligible for financial aid, a student must demonstrate Satisfactory Academic Progress (SAP) at the end of each payment period. Failure to meet Satisfactory Academic Progress (SAP) may result in loss of financial aid.

Applying for Financial Aid:

Winonah School of Cosmetology accepts Federal Student Aid for those that qualify. To apply, please complete the Free Application for Federal Student Aid (FAFSA) online at www.fafsa.gov. Enter Winonah School of Cosmetology��s school code 042735, so that your FAFSA report will be sent to the school for further review.

Winonah School of Cosmetology offers the following Federal programs for Cosmetology and Instructor (650 hrs) programs:

Pell Grant: A Federal Pell Grant is a gift aid from the U.S. Department of Education and does not need to be repaid. Information from the FAFSA determines the Expected Family Contribution (EFC) which is used to determine the maximum amount of Federal Pell Grant at student may receive in an award year (July 1st of one year through June 30th of the following year).

Federal Direct Stafford Loans (Subsidized and Unsubsidized): Federal Stafford loans are borrowed and therefore must be returned to the lender, the U.S. Department of Education. Stafford loans are borrowed by the student and are credit-based loans. The major difference between a Subsidized and an Unsubsidized Stafford loan is that the federal government pays the interest on a Subsidized Stafford loan while a student is in school, but never pays the interest on an Unsubsidized Stafford loan. A student must have a financial need to qualify for a Subsidized Stafford loan, while most students can qualify for an Unsubsidized Stafford loan regardless of income.

The U.S. Department of Education charges a fee to make a Stafford loan, meaning the student will receive less than the amount borrowed to pay educational cost. Both Subsidized and Unsubsidized Stafford loans have a fixed interest rate on the principal amount borrowed; have a six (6) month grace period before mandated repayment begins; are eligible for certain deferment, forbearance and cancellations rights; have a variety of repayment plans to choose from; and may be paid off early without penalty.

More details on federal loan types, terms and conditions, repayment plans and sample repayment schedules can be found at studentloans.gov.

To apply for a Subsidized or Unsubsidized Stafford loan, a student must complete the FAFSA. Loan eligibility requires completion of a Master Promissory Note (MPN), promising to pay the loans, and complete mandated Loan Counseling prior to disbursement. The MPN and Entrance Counseling can be completed online at www.studentloans.gov. Loans must be paid to the U.S. Department of Education to avoid severe consequences of going into default. All Direct Subsidized and Unsubsidized Stafford loans have a thirty (30) day hold on the first disbursement.

Federal Direct Parent PLUS Loans for Undergraduates: The PLUS loan is a loan that must be paid back to the U.S. Department of Education. Borrowers are restricted to biological/adoptive parents of eligible dependent students, or step parent if income information was reported on FAFSA. PLUS loans are credit based which requires the parent to provide authorization for a credit check. Once approved, the PLUS borrower must sign a Master Promissory Note (MPN), Parent PLUS Loan Counseling and provide the Financial Aid office with a loan amount request. A parent may submit the credit authorization through the Financial Aid office. Both the Credit Authorization and MPN can be accessed at www.studentloans.gov.

The U.S. Department of Education charges a fee to make a PLUS loan, meaning the parent will receive less than the amount borrowed to pay educational cost. The PLUS loan has a fixed interest rate on the principal amount borrowed; do NOT have a six (6) month grace period before mandated repayment begins but may be eligible for deferment; is eligible for certain deferment, forbearance and cancelations rights; has a variety of repayment plans to choose from; and may be paid off early without penalty.

For more information on PLUS loans and PLUS loan eligibility please visit www.studentloans.gov.

Title IV Financial and Academic Year Definition:

Winonah School of Cosmetology defines its academic year as 900 actual clock hours and 26 weeks.